Banking should be barrier-free and financial opportunity should open doors. It’s a belief at our very core, inspired by our entrepreneurial spirit, driven by the unmet financial needs of millions, and delivered by our data-driven technology.

We’re backing the UK’s most ambitious businesses with the fast, flexible finance they need to scale – and helping keen savers reach their goals along the way.

When you save with us, you’re supporting the next generation of entrepreneurs, fuelling business growth, job creation, and thriving communities across the UK.

Founded by entrepreneurs, we understand what it takes to build and scale. Since 2015, we’ve provided over £12bn in funding, helping create 56,000 new jobs and 34,000 new homes. Whether you’re looking to grow your business or grow your savings, we’re here to help.

As a fully-licensed digital bank, we offer the same level of protection as traditional high street banks. When you save with us, your eligible deposits are protected (up to £120,000) by the Financial Services Compensation Scheme (FSCS).

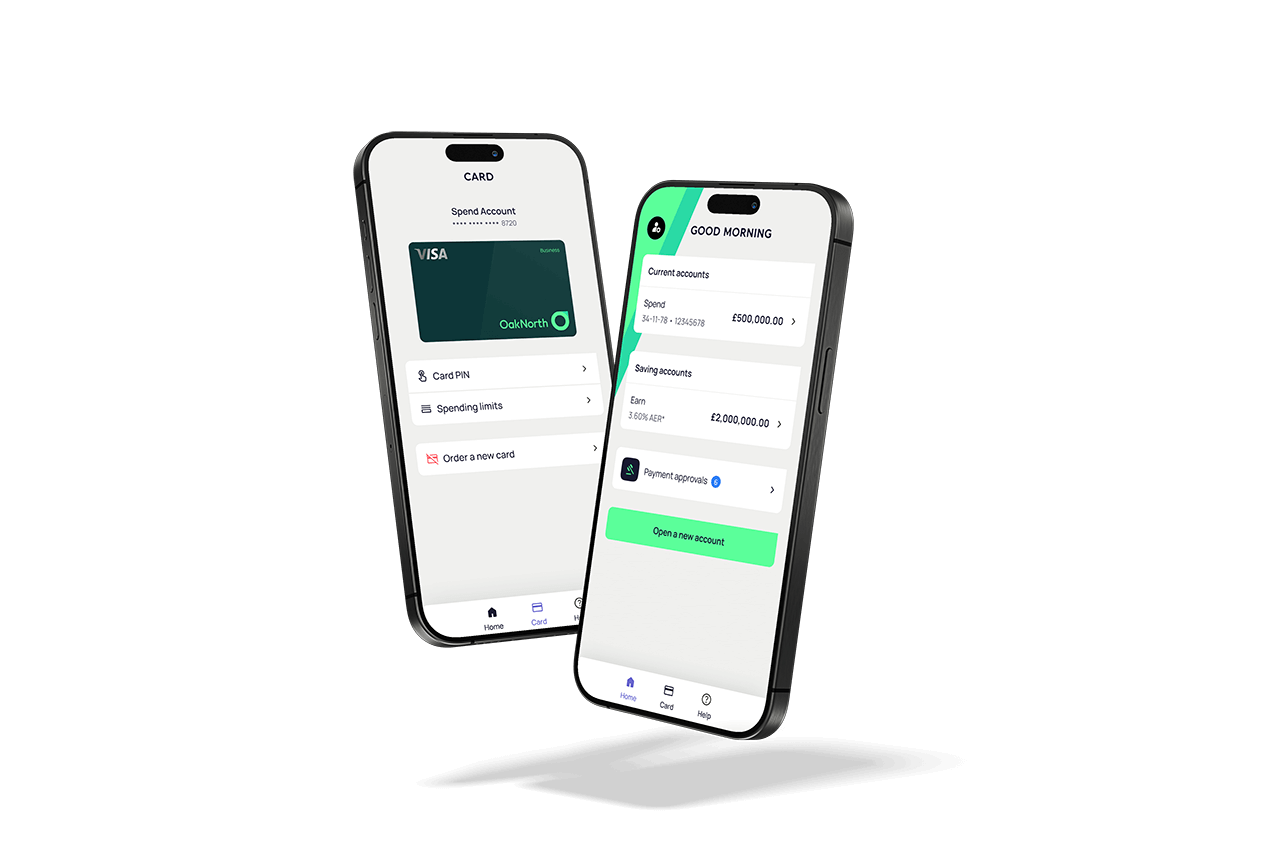

Keeping on top of your savings has never been easier. Apply for accounts, personalise your savings goals, move money and more on the go.