The property market moves fast – especially when it comes to residential investments. Despite the precarious economic climate and rising inflation, house prices haven’t plummeted – and aren’t currently showing any signs of doing so just yet. In fact, despite rising inflation, the UK rental market expects to see rising demand according to research from Handelsbanken. This, coupled with a rise in cost of living, makes it even harder for prospective buyers to join the housing ladder, which bolsters an already strong rental market in the UK.

Despite interest rates rising, the competitive landscape of residential property investments still makes it an attractive investment for newcomers, or seasoned experts with large portfolios looking to expand. In fact, a recent survey conducted by BVA BDRC shows that 15% of 700 landlords surveyed are looking to buy more buy-to-let properties in the next 12 months.

With an increasingly competitive market comes the need to be able to finance purchases quickly. It’s no longer enough for investors to have their finger on the pulse when it comes to new developments or property markets. Businesses that can access funding quickly, at exactly the right time will ultimately come out on top.

Introducing a digital-first online application

We know that the more streamlined our loan applications are, the quicker and easier it is for investors to access critical cash flow for their next residential investment. That’s why we’ve introduced our new digital application designed with residential property investors in mind.

Covering business loans from £250,000 up to £3,000,000 for residential rental properties, you can now get indicative loan terms (subject to credit approval) in just five minutes, without exchanging any emails or spending any time on the phone – if you don’t want or need to. With the introduction of our residential property investment loans via a quick and simple online application process, our goal of facilitating funding becomes a reality.

Here’s how it can help make accessing the finance you need that much easier.

One centralised application for all your loan details

Time is of the essence when securing funding for your real estate development plans, but a digital application can speed up and simplify the entire process even further. And with OakNorth you don’t need to be a digital mastermind to kickstart your application. If you are looking for a residential property investment loan of up to £3,000,000, you can apply for a loan here and you’ll be guided through each of the steps.

We also understand that searching through complex documents while on the phone with someone is not only incredibly frustrating but completely impractical. That’s why we’ve brought simple lending decisions into the 21st century: you can collate all your financial details in one place and add them to your online loan application when it suits you. So, whether you submit your application in one sitting or need some time to gather all your important details, whenever you log out all your progress will be saved, so you can always pick up where you left off.

Personalised loan terms in a matter of minutes

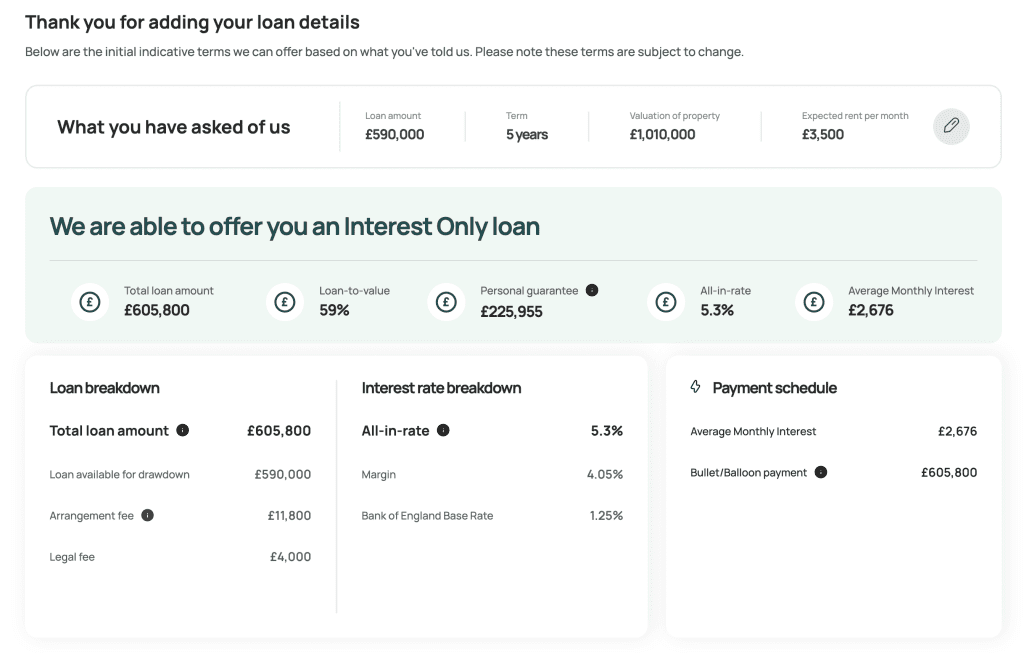

Our residential property investment loans application is simple enough that once you provide us with high-level details of the property and your lending needs, we can generate an indicative term sheet. The speedy response is great for giving you an overview of the offer you’ll receive before your application is fully complete.

Once you’ve accepted the indicative loan terms, the remainder of the application is a very quick process before you can receive a credit decision. Then, once your loan has been approved, you can review the loan documents, sign and have your loan serviced – all from within the application portal. We’ll also make sure to keep the legal process moving quickly so that you can get your loan rapidly to conclude your property investment deal.

The application only takes minutes to fill out, or longer if you’d prefer to come back and fill it out in your own time. You can also expect to receive your loan in a matter of weeks rather than months, subject to credit approval and all application details being correct.

Transparent loan structuring

It’s our mission to save you time, so that also means we won’t waste it by hiding our loan requirements. Depending on the value of your property or properties and the amount you need to borrow, we’ll let you know upfront if your loan-to-value ratio is a match.

Specialist loans, streamlined

Because our approach to lending is tailored to your specific needs, we’ll be able to give your businesses individual loan offer terms fast. We don’t just offer off-the-shelf lending and we’re able to provide these bespoke loan terms fast because we take only the relevant information from you in your application. This is part of our dedication to supporting the growth of entrepreneurship across the UK meaning that we can cater to more complex projects which other lenders may not consider.

Industry specialists working on your application

Although our residential property investment loans process is digital-first, we still have an expert human support team to process and grant your loan. Our experts have years of experience within the real estate sector – some have even become chartered surveyors to help them get to the heart of our customers’ problems and make strategic decisions that benefit the industry.

Should you need any further help with your loan application, our friendly experts are easily contactable when you need them.

Applying for your loan

Our digital application is currently only for residential investment loans ranging from £250,000 up to £3,000,000. But that doesn’t mean we can’t help you if your next real estate project falls outside of this. We offer business loans up to tens of millions of pounds for property development and investment across commercial and real estate buildings. To find out more about how we can help, visit our business loans for real estate page.